Canada’s housing market in 2024 presents a landscape of both challenges and opportunities. This year, the market shows signs of recovering from the disruptions caused by the COVID-19 pandemic. Both buyers and sellers need to know about housing market trends to navigate this changing situation effectively.

Understanding these trends is crucial. For buyers, it means finding the right time to invest or upgrade their homes. Sellers can plan to get the most money from their properties. The Canadian Real Estate Association (CREA) plays an important part in this process, giving valuable data and insights that help track market conditions.

Keeping up with market trends is essential for making informed decisions. Interested in learning how to save money when selling your property? Check out our Seller’s Guide, which offers comprehensive information on how to sell your property effectively while maximizing your profits.

For those thinking about new investments, exploring Toronto’s newest construction projects, which are shaping up to be promising opportunities, might be worth considering.

Staying updated with CREA’s data ensures you are well-prepared to make decisions that match current trends and future forecasts.

1. Canadian Housing Market’s gradual Recovery from the COVID-19 Pandemic

The Canadian housing market took a significant hit due to the COVID-19 pandemic, causing disruptions in buying and selling activities across the country. However, there are now promising signs of recovery in 2024 after a period of uncertainty and stagnation.

Signs of Recovery in 2024:

- Increased Buyer Activity: More people are re-entering the market, seeking new homes as they become more confident in economic stability.

- Rising Home Prices: Home values are steadily going back up to pre-pandemic levels.

Several key factors have contributed to this recovery:

- Government Support: The Canadian government has implemented various financial aid programs and policy measures that have helped stabilize incomes and increase buyer confidence.

- Historically Low Interest Rates: Borrowing has become more affordable with historically low interest rates, which has encouraged potential buyers to make purchases.

- Technological Advancements: The real estate industry has embraced technological advancements that have streamlined processes and made them more accessible for both buyers and sellers. For instance, innovations like virtual tours and online home valuations using a reliable Home Value Estimator have empowered individuals to make informed decisions quickly.

These factors collectively highlight the resilience of the Canadian housing market, as it gradually bounces back from the impact of the pandemic.

2. Increase in Home Sales and Prices

The Canadian housing market is experiencing a significant rise in home sales and the average home price. This trend is exciting for sellers but presents challenges for buyers navigating the competitive landscape.

Several key factors are driving this surge in demand for properties:

- Urbanisation: Cities like Toronto and Vancouver continue to attract people, driving up demand.

- Remote Work: More people are moving to suburban or rural areas while working from home.

- Population Growth: Immigration policies are contributing to an increasing population, necessitating more housing.

Interest rates play a critical role in this scenario. Lower rates have made borrowing more affordable, allowing more people to enter the market. However, as rates climb, affordability becomes a pressing issue, making it harder for some buyers to compete.

For those looking to sell, understanding these dynamics can be crucial. If you’re planning to sell your house, our guide offers essential tips that can help you navigate this competitive market successfully. On the other hand, potential buyers aiming to navigate this market can find valuable insights in our buyer’s guide which can assist them in making informed decisions while purchasing their dream home.

3. Challenges with the Canadian Housing Market Housing Supply

The Canadian housing market continues to struggle with a persistent shortage of supply. This issue is not limited to cities but also affects rural areas, making housing affordability a bigger concern nationwide.

Urban Areas

Cities like Toronto and Vancouver have high demand for housing, but there are not enough homes available. This imbalance leads to higher prices, making it harder for first-time buyers to buy a property.

Rural Markets

Even in less populated areas, the worsening housing supply issues are clear. There are not many new homes being built and fewer properties up for sale, which drives up prices and makes them comparable to urban areas.

These challenges highlight the importance of finding new and creative ways to make more homes accessible and affordable.

For property listings and more insights into the current market, visit Justo | Toronto Real Estate Brokerage where you can explore available listings and gain valuable insights into the current market trends.

4. Regional Market Dynamics

Examining the regional housing markets in Canada reveals significant provincial differences. In Toronto, the market is characterised by high demand, driven by a robust job market and immigration, leading to competitive bidding wars and rising prices. Vancouver’s market remains hot, fueled by limited land availability and foreign investments, causing a surge in luxury property prices. Montreal showcases a balanced growth pattern, with affordable homes attracting first-time buyers and investors.

- Toronto: High demand due to jobs and immigration.

- Vancouver: Limited land and foreign investments.

- Montreal: Balanced growth with affordability.

Understanding these dynamics helps buyers and sellers navigate their local markets effectively. For more insights on navigating these trends, you can visit our FAQ page which provides fast answers to common questions. You can also gain a deeper understanding of our approach in bringing affordability and excellent service to the Canadian real estate market by visiting our About Us page.

5. Impact of Interest Rate Policies

The Bank of Canada plays a crucial role in setting interest rates, directly affecting mortgage borrowing costs. When the Bank of Canada adjusts its rates, it influences the affordability of home loans, impacting both buyers and sellers.

Benefits and Risks of Continued Rate Changes:

- Benefits: Lower interest rates can stimulate the housing market by making mortgages more affordable, boosting buyer activity.

- Risks: Conversely, higher interest rates can dampen demand by increasing borrowing costs, potentially cooling down an overheated market.

Experts predict that future monetary policy shifts will continue to shape the housing sector. Some forecasts suggest a cautious approach from the Bank of Canada to avoid market instability. For ongoing updates on these trends, you can explore our Real Estate Blog, which covers Canadian real estate news, market trends, and tips on buying, selling, and renting properties across the country.

Understanding these dynamics helps buyers and sellers navigate the ever-changing Canadian housing landscape effectively.

6. Market Balance and Sales Activity

The Sales-to-New-Listings Ratio (SNLR) is a key metric for understanding market balance. It compares the number of homes sold to the number of new listings added in a given period.

- A high SNLR indicates a seller’s market, where demand outstrips supply, leading to higher prices.

- A low SNLR points to a buyer’s market, where there’s abundant supply relative to demand, often resulting in lower prices.

Current data suggests that many Canadian markets are experiencing tight conditions, with high SNLR values indicating robust competition among buyers. This dynamic underscores the importance of strategic planning for both buyers and sellers navigating these fluctuating supply-demand scenarios.

7. Long-Term Sustainability of Price Growth

Understanding sustainable home price appreciation is crucial in the Canadian housing market. Sustainable price growth means that home values increase at a steady, manageable rate, avoiding extreme spikes or drops that can destabilise the market.

In 2024, there’s growing concern about whether certain areas might be at risk of experiencing a price bubble. Major cities like Toronto and Vancouver, where property prices have skyrocketed in recent years, are often scrutinised for their long-term sustainability. Analysts suggest that while demand remains robust, the key is balanced growth backed by economic fundamentals rather than speculative investments.

Key indicators to watch include employment rates, income growth, and housing supply levels, all playing significant roles in maintaining sustainable price growth across Canada.

8. The Role of Government Policies

Government policies have played a significant role in maintaining stability in the Canadian housing market. Here are some key measures:

- Foreign buyer taxes: These taxes were introduced to discourage speculative investments, particularly from overseas buyers. As a result, cities like Vancouver and Toronto have seen a decrease in rapid price increases.

- Mortgage stress tests: These tests ensure that potential homeowners can afford their mortgage payments even if interest rates go up. This helps protect Canadians from financial stress in the future.

Looking ahead, there is a possibility for further government intervention through regulations to address ongoing concerns in the housing market:

- Focus on increasing the supply of affordable housing

- Tightening regulations on speculative buying

These potential policies aim to create a balanced market where both affordability and investment growth can be sustained. Some specific measures could include:

- Providing incentives for the construction of rental properties

- Expanding tax credits for first-time homebuyers

9. Technology Advancements and Real Estate

Technology is having a huge impact on the real estate industry in Canada, bringing about major changes and new opportunities. Here are some key areas where this transformation is happening:

- Proptech Startups: These companies are completely changing how properties are managed, transactions are carried out, and customers are served. Platforms like Zillow and Redfin offer advanced search tools, virtual tours, and AI-powered recommendations.

- Digital Marketing Strategies: Real estate agents are using social media, SEO, and online advertising to reach a wider audience. Virtual reality (VR) and augmented reality (AR) technologies allow potential buyers to explore properties from anywhere.

By adopting these technologies, the real estate sector can become more efficient, transparent, and customer-centric. This marks a significant shift in how properties are bought and sold across Canada.

10. Embracing Sustainability in Housing

Sustainability has become a major focus for the Canadian housing market. Buyers are increasingly demanding green building initiatives and energy-efficient homes. These features not only reduce environmental impact but also result in long-term cost savings through reduced utility bills.

Stricter Building Codes and Incentives for Retrofitting

Governments are pushing for stricter building codes to ensure new developments meet high sustainability standards. This includes incentives for retrofitting older homes with modern energy-efficient solutions.

Integration of Sustainable Practices by Builders and Developers

Builders and developers are responding by integrating sustainable materials, advanced insulation, and renewable energy sources like solar panels into their projects. These trends reflect a shift towards eco-friendly living that aligns with both consumer preferences and regulatory requirements, making sustainability a key element of the future housing landscape.

Conclusion

Keeping up with the Canadian housing market in 2024 is crucial for making informed decisions. The landscape is dynamic, influenced by a variety of factors such as interest rates, government policies, and emerging technologies. Staying informed about these trends can help you adapt to changing conditions effectively.

Key Recommendations:

- Stay Informed: Regularly check updates from reputable sources like the Canadian Real Estate Association (CREA). Understanding the latest data and trends will give you an edge in this competitive market.

- Seek Professional Guidance: Whether you are buying or selling, professional advice can be invaluable. Real estate professionals bring deep market knowledge and strategic insights that can help you navigate complexities.

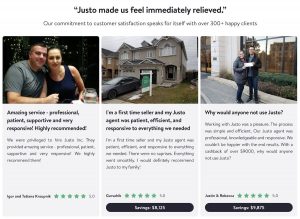

Remember, Justo is here to assist with low commission transactions, providing more value and ensuring you get the best deal possible. Stay engaged with future trends to maximise your opportunities in the Canadian housing market.

What is the impact of the COVID-19 pandemic on the Canadian housing market?

The COVID-19 pandemic has had a significant impact on the Canadian housing market in recent years, causing disruptions in sales and prices. However, there are signs of gradual recovery observed in the market for 2024.

What are the projected growth in home sales and prices, and its implications for buyers and sellers?

The projected growth in home sales and prices signifies an increase in demand, which has implications for both buyers and sellers. Buyers may face higher competition and affordability challenges, while sellers may benefit from increased property values.

What are the ongoing challenges related to housing supply across Canada?

The ongoing challenges related to housing supply include a shortage of supply, which is impacting both urban and rural markets as well as affordability. These issues are contributing to the overall dynamics of the Canadian housing market.

Can you provide a comprehensive analysis of major provincial housing markets in Canada?

Major provincial housing markets such as Toronto, Vancouver, and Montreal have unique factors influencing their market dynamics. It’s important to understand these regional differences when considering real estate investments.

How does the Bank of Canada’s interest rate decisions affect the housing market?

The Bank of Canada’s interest rate decisions have a direct impact on mortgage borrowing costs, influencing affordability and competitiveness in the housing market. Future policy shifts can have implications for both buyers and sellers.

What is the concept of sustainable price growth in the housing market context?

Sustainable price growth refers to an appreciation in home prices that is supported by economic fundamentals rather than speculative factors. It’s important to assess whether certain areas in Canada are at risk of experiencing a price bubble due to unsustainable growth.

- The Impact of Interest Rate Cuts on Toronto’s Housing Affordability - April 23, 2025

- Bank of Canada Holds Interest Rate Steady Amid Tariff Uncertainty - April 19, 2025

- The Impact of Interest Rate Cuts on Toronto’s Housing Affordability - April 11, 2025