- Buying your first home in the Greater Toronto Area (GTA) is an exciting milestone but can also feel overwhelming. From understanding market trends to securing the right financing, many factors must be considered.

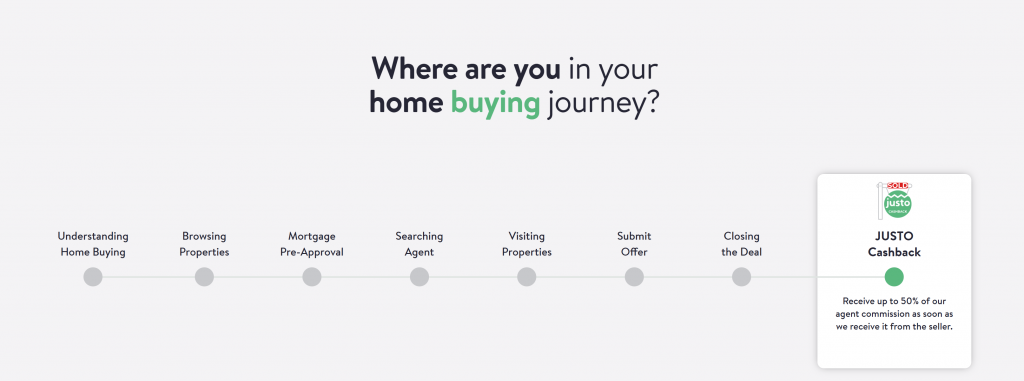

- Justo is here to simplify the process, offering expert guidance and financial benefits like cashback incentives to help you get the most out of your purchase. This guide breaks down the essentials for first-time buyers and highlights how Justo makes homeownership in the GTA more accessible and rewarding.

- Understanding the GTA Market

- The GTA market is dynamic, with various property types, neighbourhoods, and price points. Recent trends indicate continued demand for suburban areas like Milton, Whitby, and Brampton, where buyers can find more space for their money. Condos remain a popular choice for first-time buyers due to their affordability and central locations.

- It’s essential to familiarize yourself with average home prices in the area you’re considering. For example, as of late 2024, detached homes in suburban regions can range from $900,000 to $1.2 million, while condos in downtown Toronto may start at $600,000. Understanding these benchmarks helps you set realistic expectations and narrow your search effectively.

- Setting Your Budget

- Determining your budget is one of the most critical steps in the home-buying process. Start by evaluating your savings, monthly income, and expenses. Factor in additional costs like property taxes, utility bills, and maintenance fees.

Key Tips:

- Get Pre-Approved for a Mortgage: This gives you a clear idea of your borrowing capacity and demonstrates to sellers that you’re a serious buyer.

- Consider the Downpayment: In Canada, the minimum downpayment is 5% for homes priced below $1,500,000 and increases for higher-priced properties. Aim to save more if possible, as a larger down payment reduces your mortgage and associated interest costs.

- Account for Closing Costs: These typically include legal fees, land transfer taxes, and home inspection costs, averaging 1.5% to 4% of the home’s purchase price.

- Finding the Right Neighbourhood

- Location is one of the most important factors when buying a home. Consider proximity to work, schools, public transit, and amenities. Each GTA neighbourhood offers a unique lifestyle, so it’s essential to align your priorities with what the area provides.

- Popular Neighbourhoods for First-Time Buyers:

- Scarborough: Affordable homes with excellent transit links and diverse communities.

- Mississauga: Known for its family-friendly vibe and robust job market.

- Etobicoke: Offers a balance of suburban living with access to downtown Toronto.

Justo’s agents can help you evaluate neighbourhood options based on your preferences and budget, ensuring you find a location that suits your lifestyle.

- Choosing the Right Property

- First-time buyers often face a choice between condos, townhomes, and detached houses. Each option has its pros and cons, depending on your lifestyle and financial goals.

- Condos: Less upkeep and amenities like gyms or pools make condos attractive to younger buyers. However, be mindful of monthly maintenance fees.

- Townhomes: These offer more space and are a middle ground between condos and detached homes.

- Detached Homes: Ideal for families or those needing extra space, but they often come with higher costs and maintenance responsibilities.

Working with Justo allows you to explore these options with expert guidance. Their agents provide detailed assessments of properties, helping first-time buyers weigh factors like maintenance responsibilities, future resale value, and lifestyle fit before making a decision.

- Leveraging Justo’s Cash Back Incentives

- One of the standout benefits of working with Justo is the cashback program, which can significantly offset your costs as a first-time buyer. When you purchase a home through Justo, you can receive up to 50% of the commission Justo earns. Justo’s cashback program provides financial flexibility after closing. Buyers can use these funds for post-purchase expenses like renovations, furnishings, or building an emergency reserve.

- For example, buying a $700,000 home could earn you approximately $7,250 in cashback. This program has helped hundreds of first-time buyers ease the financial burden of homeownership To see exactly how much cashback you’ll receive, visit Justo.ca and use the cashback calculator.

Preparing for the Offer Process

- Once you’ve found a property you love, the next step is making an offer. The GTA market can be competitive, so it’s essential to act quickly while being strategic.

- Tips for a Successful Offer:

- Understand Market Value: Your agent will provide a comparative market analysis to ensure your offer is competitive yet reasonable.

- Include Conditions: Common conditions include financing approval and a satisfactory home inspection. These protect you from unforeseen issues.

- Be Flexible: Sellers may prioritize buyers with flexible closing dates or fewer conditions, so be prepared to adapt if needed.

Justo’s agents have extensive experience in crafting winning offers and will guide you through this crucial step.

- The Importance of a Home Inspection

- A home inspection is a vital part of the buying process, especially for first-time buyers who may be unfamiliar with potential pitfalls. An inspection can reveal issues like structural damage, plumbing problems, or outdated electrical systems, allowing you to renegotiate or walk away if necessary.

- Justo connects clients with trusted home inspectors who provide detailed reports, ensuring you make an informed decision.

- Closing the Deal

- Closing is the final step in your home-buying journey, but it involves several important tasks:

- Ensure all paperwork is in order and your lender has the necessary documentation.

- Work with a real estate lawyer to review the purchase agreement, title, and any other legal documents.

- This allows you to confirm that the property is in the agreed-upon condition before taking possession.

Justo’s team works closely with you and your lawyer to ensure all documentation is complete and the closing process is seamless.

- Why Choose Justo for Your First Home?

- Buying your first home is a life-changing experience, and having the right support makes all the difference. Here’s why first-time buyers in the GTA choose Justo:

Transparency: From commissions to closing costs, Justo provides clear, upfront information so there are no surprises.

Savings: The cashback program offers tangible financial benefits, helping you stretch your budget further.

Expert Guidance: Justo’s agents are seasoned professionals who take the time to understand your needs and guide you every step of the way.

Comprehensive Services: From legal support to home inspections, Justo connects you with a valuable network of professionals that ensures you have everything you need for a seamless buying experience.

- Looking Ahead

- As you embark on your journey as a first-time buyer, partnering with Justo ensures you’re supported by a team that prioritizes your success. With a commitment to transparency, affordability, and exceptional service, Justo makes the GTA market more accessible than ever.

Contact Justo today and discover how their expert agents and cashback program can make your journey seamless and rewarding, to take the first step toward owning your home.

- The Impact of Interest Rate Cuts on Toronto’s Housing Affordability - April 23, 2025

- Bank of Canada Holds Interest Rate Steady Amid Tariff Uncertainty - April 19, 2025

- The Impact of Interest Rate Cuts on Toronto’s Housing Affordability - April 11, 2025